Core Banking & Digital Banking Solutions

End-to-end core banking modernization, integration, and support services to power secure, scalable, and digital-first financial institutions.

Modernizing Core Banking for a Digital Financial Ecosystem

V-Tech empowers banks and financial institutions to modernize their core banking platforms, streamline operations, and enable digital-first services. Our expertise spans implementation, migration, performance tuning, and integration with payment systems, digital channels, and regulatory platforms.

We support institutions transitioning from legacy infrastructure to modern core architectures — ensuring security, regulatory compliance, performance, and customer-centric service delivery.

Accelerate core modernization with minimal disruption

Strengthen compliance, risk control, and operational resilience

Enable seamless real-time integration with digital banking and payments

Boost performance, reliability, and data accuracy

Implementation & Upgrade

End-to-end Core Banking implementation and version upgrade services — ensuring smooth rollouts, regulatory alignment, and operational readiness.

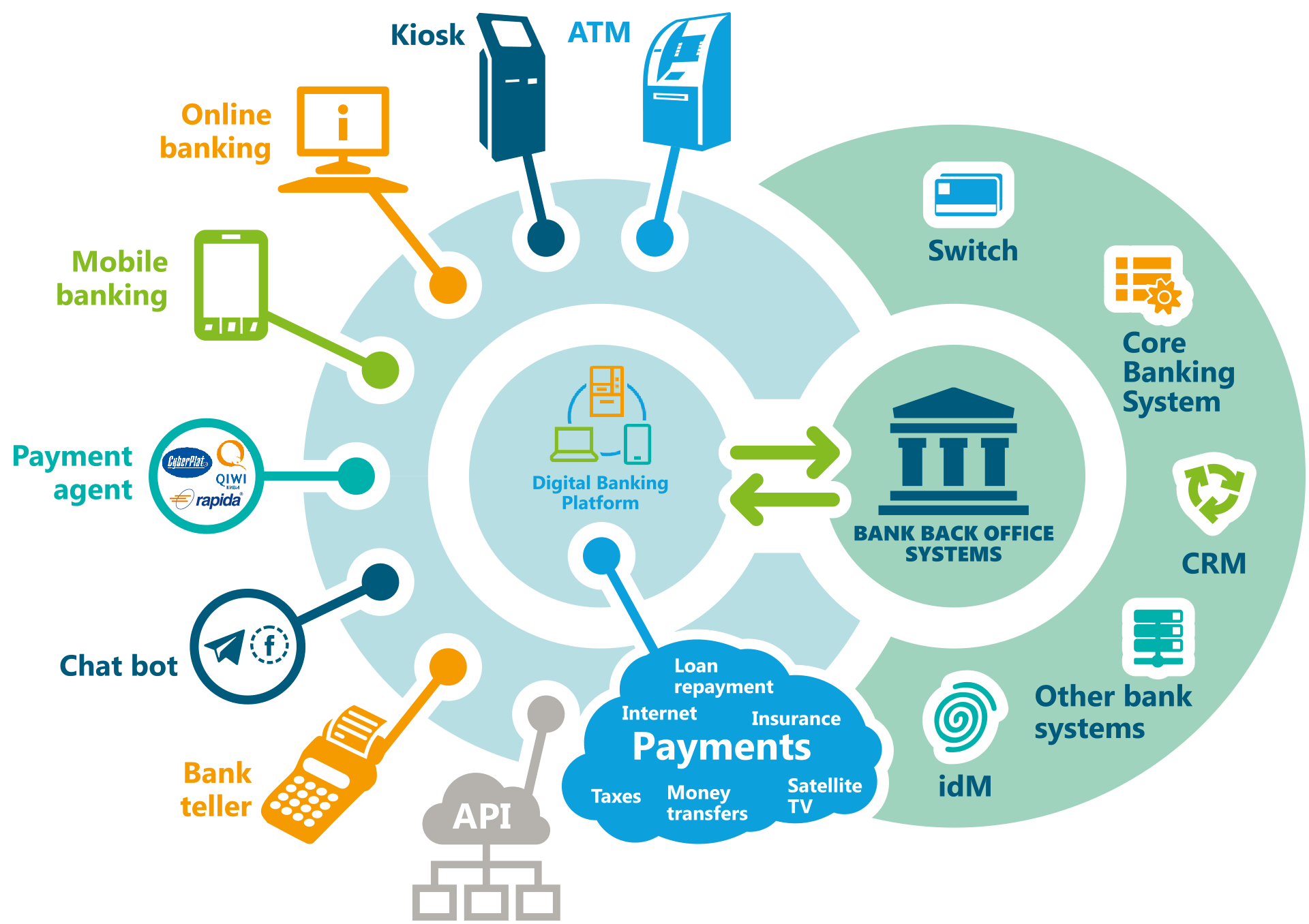

System Integration & Digital Ecosystem Enablement

Secure real-time integration with payment systems, mobile & internet banking, CRM, ERP, and regulatory platforms for a unified digital banking ecosystem.

Data Migration & Reengineering

Comprehensive data migration solutions covering mapping, cleansing, transformation, and reconciliation, supporting core reengineering and modernization programs.

Performance Tuning

Resolve performance bottlenecks, improve processing efficiency, and tune database & application layers for high-volume, real-time banking environments.

SLA & Managed Support

Structured SLA-based managed services, including incident response, monitoring, enhancements, and ongoing regulatory updates to maintain stability and resilience.

Why Choose V-Tech For Core Banking and Enterprise Solutions

V-Tech combines deep industry knowledge with technical delivery excellence to provide core banking and enterprise solutions that are robust, scalable, and aligned with business and regulatory needs. Our experience spans implementation, integration, optimization, and post-deployment support for financial institutions of all sizes.

Core Banking Expertise — Proven experience modernizing core banking systems to enhance performance, flexibility, and customer experience.

Integration Capability — Strong background integrating core platforms with digital channels, payment gateways, and regulatory systems.

Operational Resilience — Frameworks designed for system stability, data integrity, and continuous performance improvement.

Regulatory Alignment — Deep understanding of local and regional compliance requirements ensures smooth regulatory adoption.

End-to-End Delivery — From strategy and design to deployment and managed support, we deliver comprehensive lifecycle coverage.

Modernize, optimize, and secure your core banking environment with end-to-end services tailored to your institution’s regulatory and operational realities.